The Future of Denton County Real Estate: 2026 Outlook

By Robert Wink, Realtor – Denton County, TX

As we look ahead to 2026, the Denton County real estate market stands on the brink of notable shifts. With rising inventory, moderate price adjustments, and evolving buyer behavior, here’s what homebuyers, sellers, and investors should know.

1. Rising Inventory & Buyer-Friendly Conditions

Denton County is seeing a marked increase in available homes, easing the previously tight market. Active listings are up significantly year-over-year in numerous DFW counties—many exceeding 50% gains—signaling a more balanced market that favors buyers. mdregroup.com

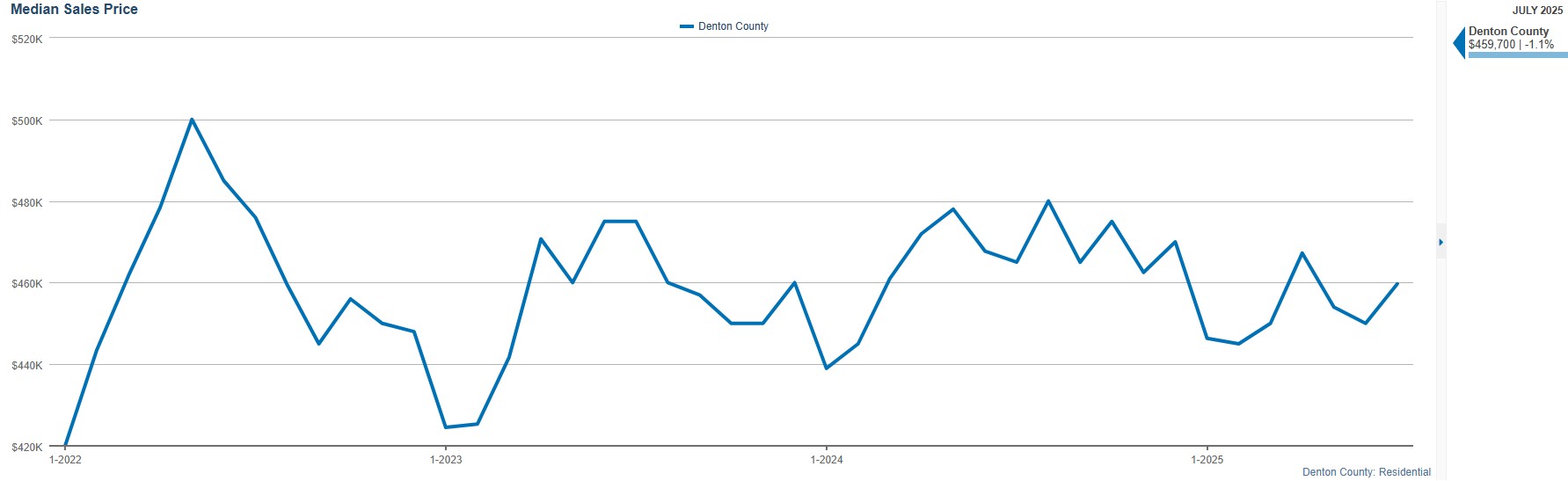

2. Stable to Slightly Softening Prices

-

As of July 2025, the median home price in Denton County fell slightly to $460,000, down 1.1% from the prior year. Homes are taking longer to sell—48 days on market compared to 35 days previously. Redfin

- This is an average by Redfin, but each home size, neighborhood, school district, and city may have less or more days.

-

Zillow reports a -3.7% annual decline in home values, with the average home value around $456,698.Zillow

These figures show modest price corrections, not steep declines—offering opportunities for savvy buyers and cautious sellers alike.

3. Forecast: Buyer’s Market Nearing

Experts anticipate that by early 2026, the greater DFW area—including parts of Denton County—could tilt toward a buyer’s market. Here’s why:

-

Prices are expected to remain flat or dip further in some segments.Home Buying Institute

-

Inventory continues to climb, giving buyers more options and time.mdregroup.comHome Buying Institute

-

Mortgage rates remain elevated (typically above 6%), limiting some demand.Home Buying Institute

For Sellers: expect more negotiation and be prepared to offer incentives or rate concessions.

For Buyers: increased inventory and slower pace can open the door for better deals and less competition.

4. Long-Term Outlook & Growth Potential

Looking further ahead, projections suggest long-term home price appreciation in Denton…

Historically as September, October, November, December, January, and February (Fall & Winter), prices drop on homes.

Interest Rates are at upper 6% and lower 7%. This may hold, having more homes on the market, dropping the prices throughout Denton. Multiple master planned communities are being developed, which will increase inventory.

While short-term trends are leaning buyer-friendly, the region’s fundamentals—population growth, infrastructure, and quality of life—support healthy long-term appreciation.

I see interest rates dropping in the Spring & Summer of 2026 due 468 seats in the U.S. Congress (33 Senate seats and all 435 House seats) are up for election on November 3, 2026.

5. Local Drivers to Watch: Development & Infrastructure

-

Commercial expansion is a big factor: H-E-B recently acquired 23 acres in Flower Mound to build a major new store—part of broader plans tied to the development of Furst Ranch (a massive mixed-use community slated to include thousands of homes and millions of square feet of commercial space).Chron

Projects like these will continue to energize housing demand, improve infrastructure, and elevate property values across Denton County.

Summary Table: 2026 Outlook at a Glance

| Factor | What to Expect |

|---|---|

| Inventory | Rising—more options for buyers |

| Median Prices | Flat to modest decline |

| Market Balance | Shifting toward buyer’s market |

| Mortgage Rates | Staying elevated, limiting demand |

| Long-Term Value | Appreciation projected over next 5–10 years |

| Development | Strong commercial/residential growth boosting demand |

How to Play the 2026 Market

For Buyers:

-

Act strategically—more choices through 2026.

-

Get pre-approved to stand out.

-

Consider new construction or resales in growing areas.

For Sellers:

-

Price competitively—don’t overestimate your leverage.

-

Focus on staging, curb appeal, and marketing to differentiate.

-

Be open to incentives like credits or flexible closing terms.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link